There are times when the information written on the checks you have issued come out incorrect or wrong, and you have no choice but to void the check before the money gets pulled out. The question this article is going to discuss is—undeniably—how to void a check?

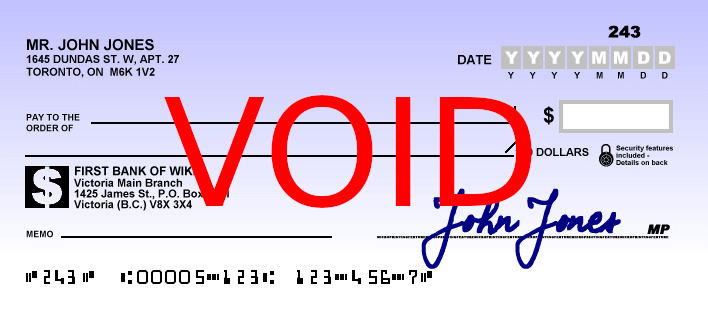

Either it’s your first time voiding a check or having seen another voiding theirs, a voided check is a cancelled check with the word scribbled “VOID” in front of it. The particular term refers to the fact that your check won’t be regarded as the official payment since you have “disabled” it—regardless if it’s still blank or not.

In principle, the voided check won’t be usable even if someone steals it and tries to fabricate the content. It’s why besides nullifying incorrect information, voiding a check also helps to set up immediate bill payments and deposits.

There are many ways to void your check based on different circumstances, which we’re going to list down in detail below. Fortunately, the procedure is relatively straightforward and easy-to-understand. However, it’s still better for you to comprehend how to execute it carefully to avoid someone else re-using the piece fraudulently.

Voiding a Check, You’re Still Holding On

People who have done it may tell you to write the word “VOID” in large letters, and this is a pretty standard method. How to void a check when you still have it with you?

-

Get a pen

Never use a pencil since it’ll get erased easily—either intentionally or not, and try to keep it professional by using black or blue markers rather than other coloured ones. The point of voiding your check is not to let the marks hardly get removed or obscured in any way.

-

Write “VOID”

If the check is still blank, go ahead and write the word “VOID” across all the lines. Otherwise, first scribble the words over the payee line, the check receiver. Usually, it’s in capital letters, and you’ll write it in the payee line to signify that the check is already void when you or someone else reads it.

-

Write “VOID” in the payment amount box.

Next, do the same thing over the payment amount box, a place where you typically put the check’s value.

-

Write “VOID” in the signature box.

You can find it in the bottom right corner before writing the same word over there. (Please note that these arrangements are the most standard version of a piece of a check paper.)

-

Record the voided check

Now that your check has been voided, it’s time to record it accurately. As you already know, every piece of a blank check comes with its number. If you miss recording the voided check, you’ll have a hard time locating its whereabouts after time passes.

You can start creating the history of all voided checks in your chequebook as well as online banking software. That way, it’s more accurate and comfortable to locate and keep track of your cancelled checks to prevent future confusion and maintain reliable and up-to-date financial records.

Important information to note in your check register will be best to include who and why void the checks. In this case, you’re going to write your name along with a few words on the reason like “wrote the incorrect amount.”

As has been said previously, perhaps you need to void the check since you want to set up a direct deposit. Interestingly, paper checks have been gradually shifted to electronic direct deposit, whose practice is often issued with a new employer. If the reason you’re voiding the check is this, then don’t forget to write it down.

Cancelling a Check after Sending It

You still can void your check even after you issued and sent it to the receiver. The faster you notice the incorrect amount written on it, the better it is to void the check before the money gets to the other side. Take note, though, that any incurring fees may occur depending on your bank policy.

How to void a check after sending it? Here is what you should do.

-

Collect all the required information

First of all, you’re going to cancel the flow, making it slightly different from voiding a check.

The first step in halting a check payment after delivering the check is by preparing all relevant information before asking for assistance from the bank. The bank is busy, and they handle thousands of inquiries every day. You’ll help both yourself and the bank from a great deal of time once you have all the vital information on the check you wish to cancel.

Feel free to consult any colleague or acquaintance that uses similar bank service (and who has gone through this procedure) with you regarding what information they usually need to help you cancel the check. If it isn’t doable, typically you have to ensure having the following details:

- The check number

- The amount of the check

- The date of the check

- The payee

- The reason for you to stop the payment

-

Void the check online

Again, depending on your bank, cancelling your check may also be possible via your online banking account directly, which can be highly efficient if you can’t make time to process it now in the bank.

Usually, you’re going to be given the “Stop Payment Order,” which—as its name explains—refers to an order to the bank not to process the payment from an issued yet not cashed check.

Typically, you’ll start by logging into your bank account, click on the customer services, and choose options to either void a check or halt a check payment. Select which one you need and then cancel the appropriate check number. Recheck the number before completing the process to ensure you’re not balancing the improper payment.

-

Phone your bank

This last method is highly efficient for you who have no time to cancel the check payment yourself or have no online banking access.

Call your bank directly and ask them for the “Stop Payment Order,” and don’t forget to prepare all the required information earlier to speed up the process.

Things to Note about How to Void a Check

This part can also serve as warnings:

- A filled out Stop Payment Order mostly expires after six months, which you can renew for another six months.

- After ordering a Stop Payment Order orally, don’t forget to fill it out and confirm the order in clear writing. Otherwise, the form will lapse after 14 calendar days (which may differ depending on your bank policy, again).

Helpful Tips

Isn’t it pretty easy to void a check? After answering the question of “how to void a check,” complete your reading with some helpful tips that’ll further smooth the process:

- Always aim for a permanent marker or a clear-tinted ballpoint pen to produce clear “VOID” words.

- If writing the check isn’t possible at the moment, you can also rip it up or shred the paper instead. However, it’s still important to record the voided check in your chequebook.

- A proper recording of all your voided checks and Stop Payment Orders will help you better when the bank already cashes the payment.

- As long as the payment hasn’t gone through or deposited, cancelling the check and obtaining a refund is much easier to do. Otherwise, your bank may require additional steps or information on the process—hence, always consult their policy first.

- The refund process, in particular, can take a while. Expect to wait in about 30 to 60 days after you have filled out the order or mailed the form to the bank.

- Most banks already have online services to assist their customers regarding this matter, which is why it’s highly suggested for you to find out whether you can set up an entirely online bank account for more straightforward banking procedures instead.

- Keep a copy of the voided check, too—even when it’s shredded—by copying or scanning it. Although this one can be a hassle, there’ll be times in the coming years where this record can be useful for similar or different banking procedures. Real or original check is skip-able, so don’t worry.

- Ensure to keep all the records somewhere safe.

We hope our information and answer to “how to void a check” above can satisfy your needs! Last thing from us: all of the processes earlier can also be applicable when you accidentally create a mistake while writing the check. You can go ahead and write another after voiding the previous one, so another party won’t re-use it. The key always lies in one thing: proper recording!

More tutorial:

How to Get Facebook Marketplace Icon on Android

How to Delete All Gmail Emails at Once on Android

Source:

https://www.wikihow.com/Void-a-Check